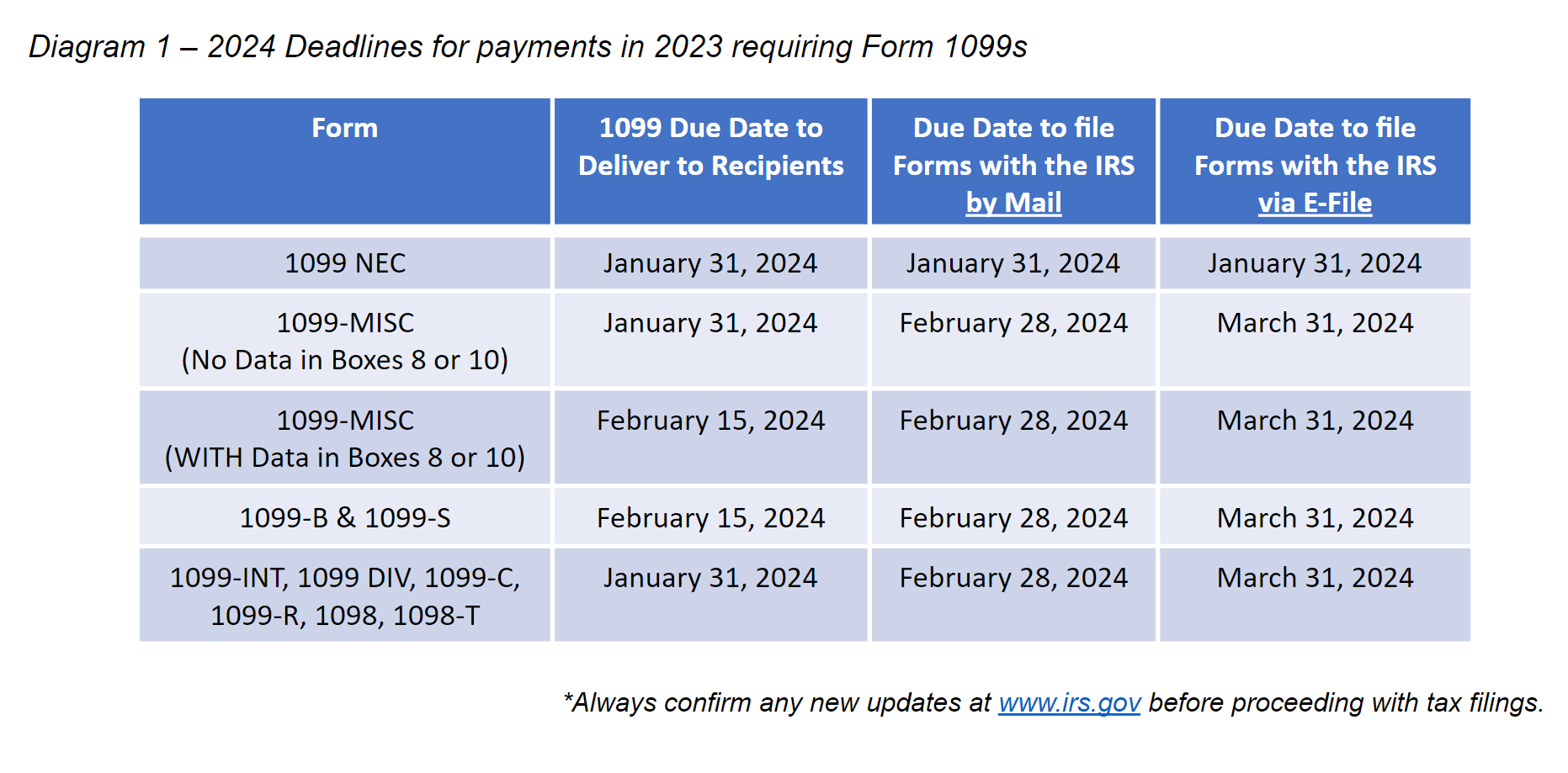

Deadline For 1099s 2024 To Be Paid – Federal income tax returns are due on April 15, but there are several other important dates to remember throughout the year. . As the calendar turns over to a new year, taxes may be the last thing on your mind. But part of your annual financial review should always include a look at upcoming tax deadlines so you can avoid .

Deadline For 1099s 2024 To Be Paid

Source : blog.checkmark.com

Bluevine on X: “It’s never too early to get prepared for the 2024

Source : mobile.twitter.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

Bluevine | Business Banking on Instagram: “It’s never too early to

Source : www.instagram.com

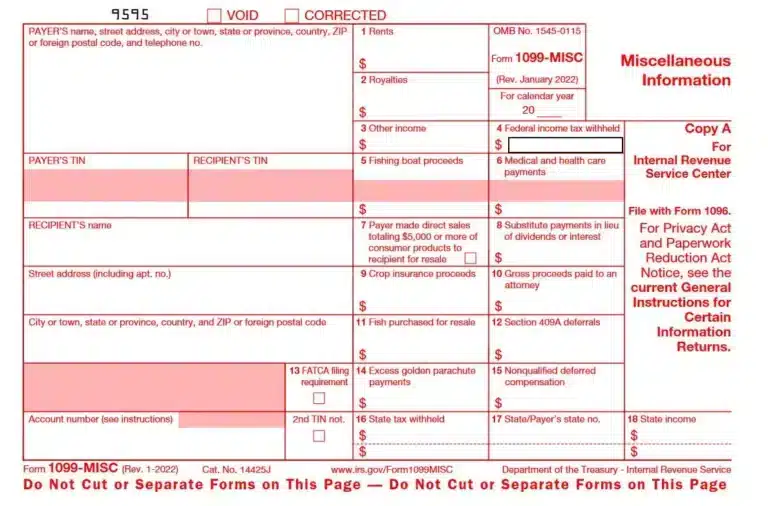

1099 MISC: Upcoming Tax Deadlines and When to Use 420 CPA

Source : 420cpa.com

1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.com

Form 1099 MISC Explained: Instructions and Uses

Source : tipalti.com

Penalties for Missing the 1099 NEC or 1099 MISC Filing Deadline

Source : www.tax1099.com

Deadline For 1099s 2024 To Be Paid 1099 Deadlines, Penalties & State Filing Requirements 2023/2024: If you’re an independent contractor earning income outside of a traditional job, you should receive your 1099 tax form by Feb to be filed by the April 15, 2024 deadline. Tax deductions: Driving . Here’s everything you need to know about the child tax credit, student loan forgiveness, and Venmo reporting requirements this tax season. .