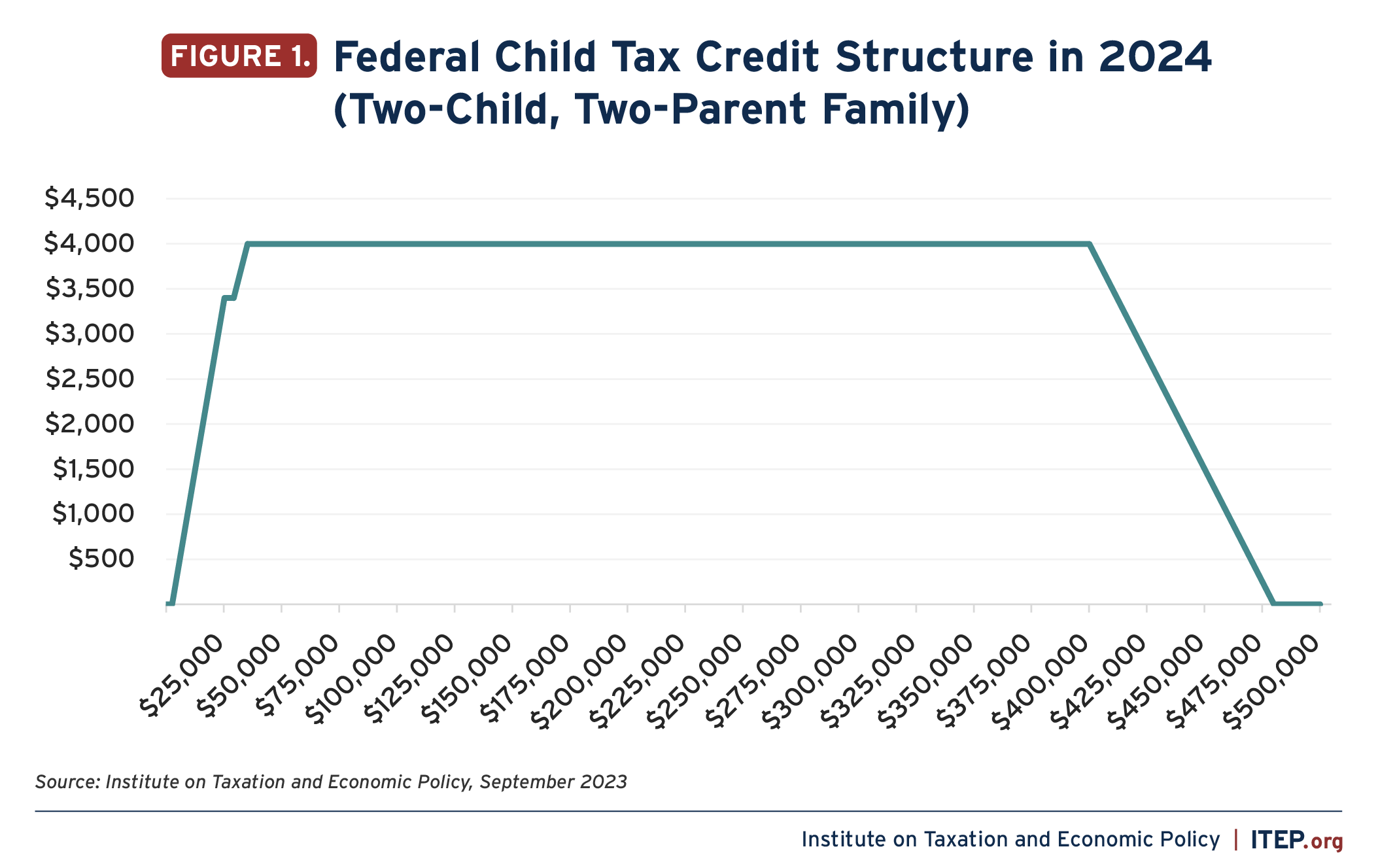

Child Tax Credit 2024 Phase Out Amount – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Child Tax Credit 2024 Phase Out Amount

Source : itep.org

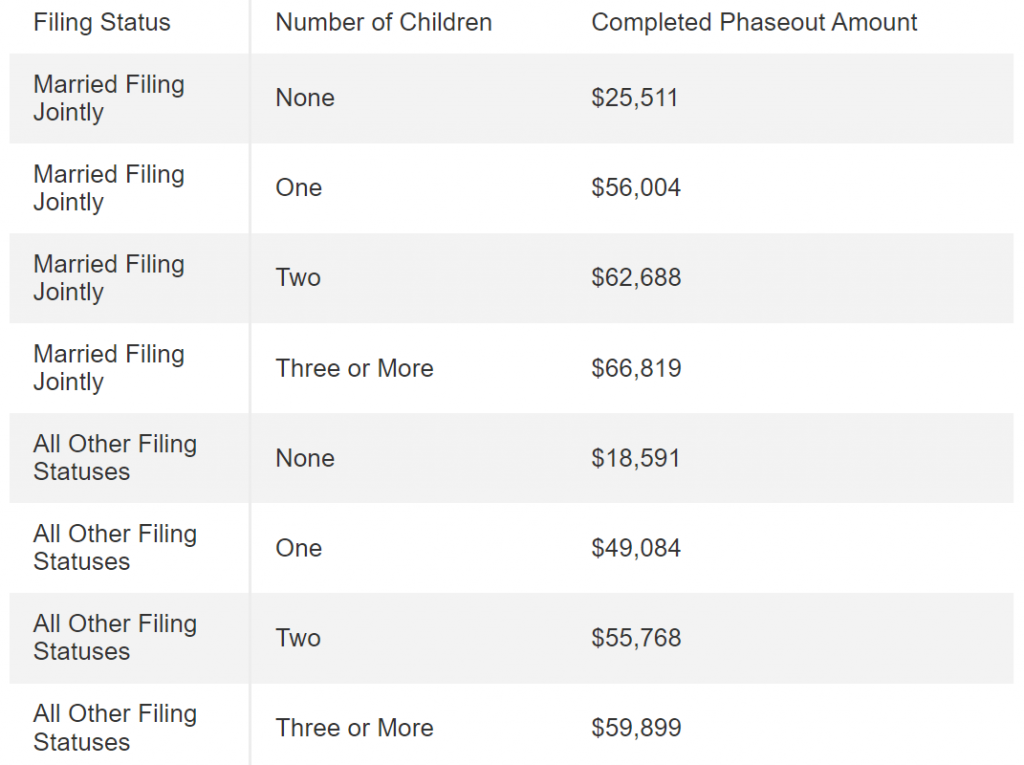

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

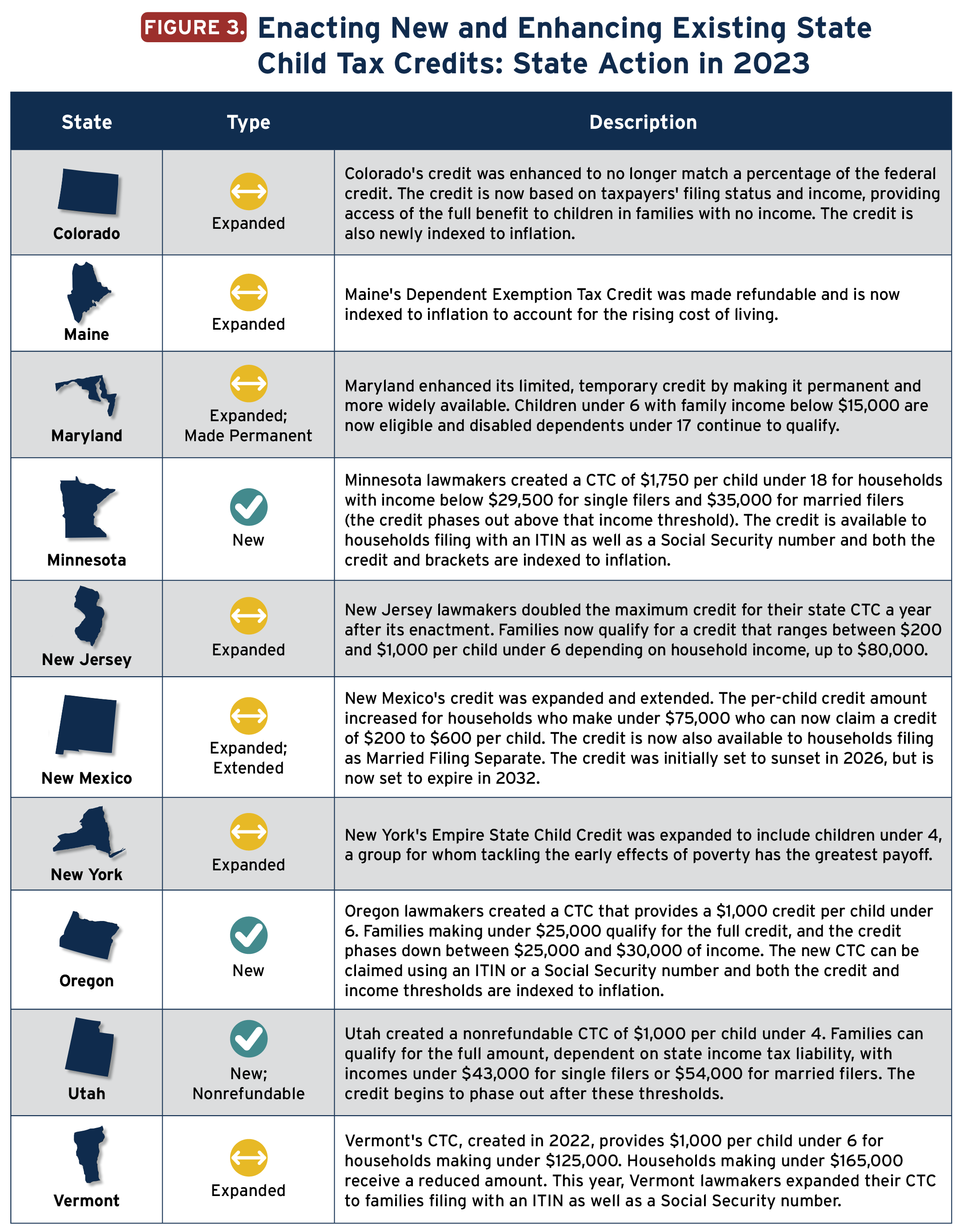

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

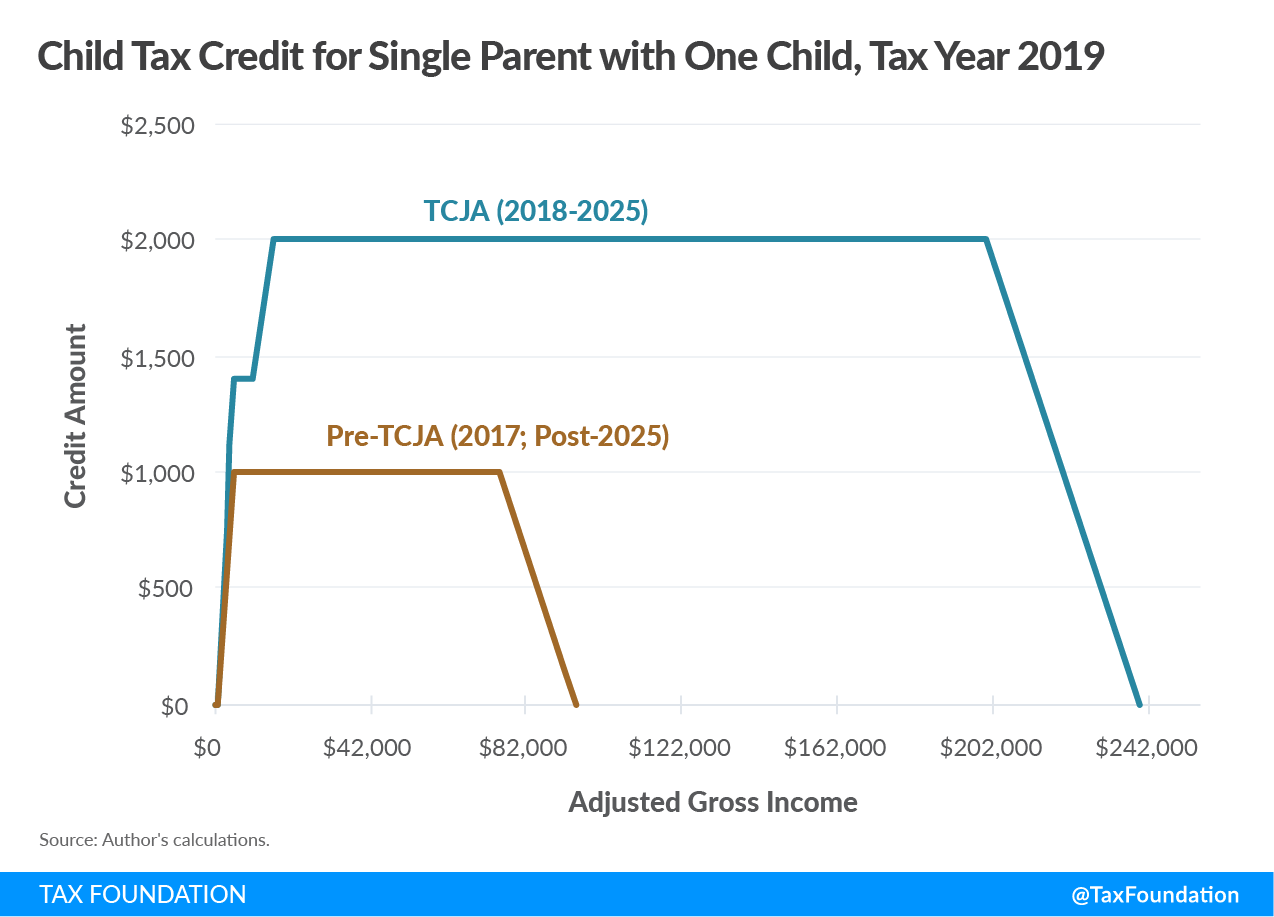

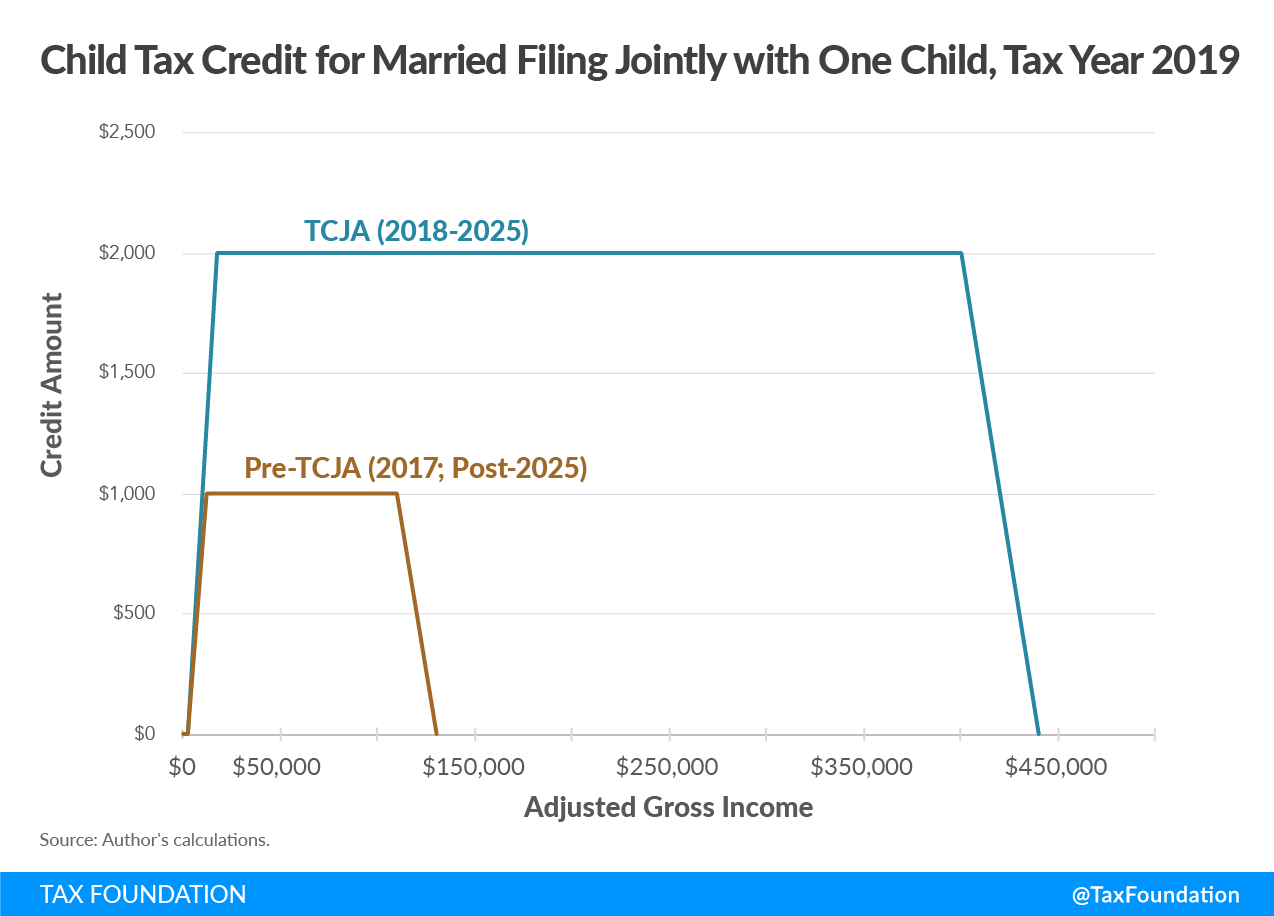

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

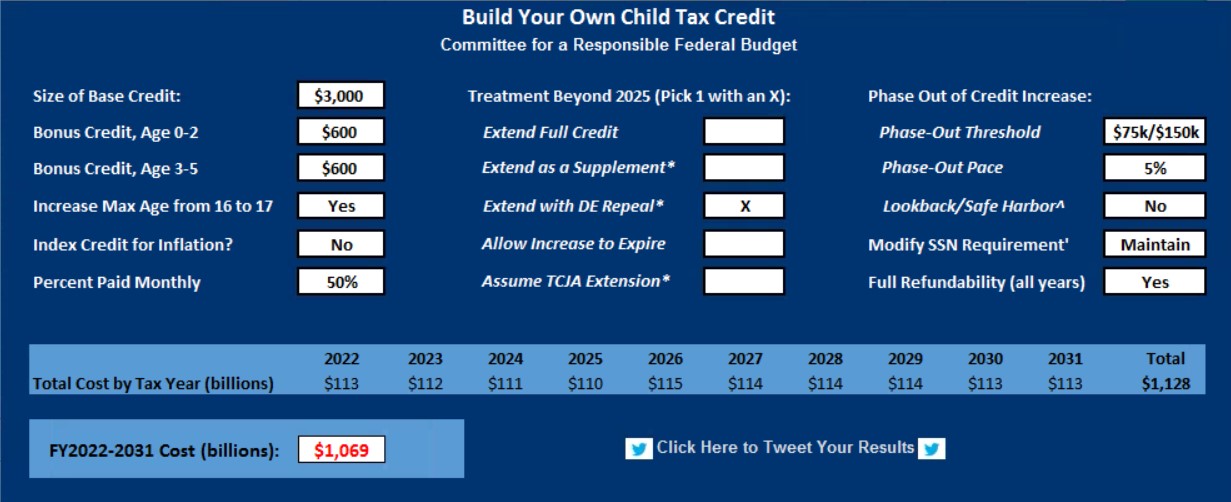

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

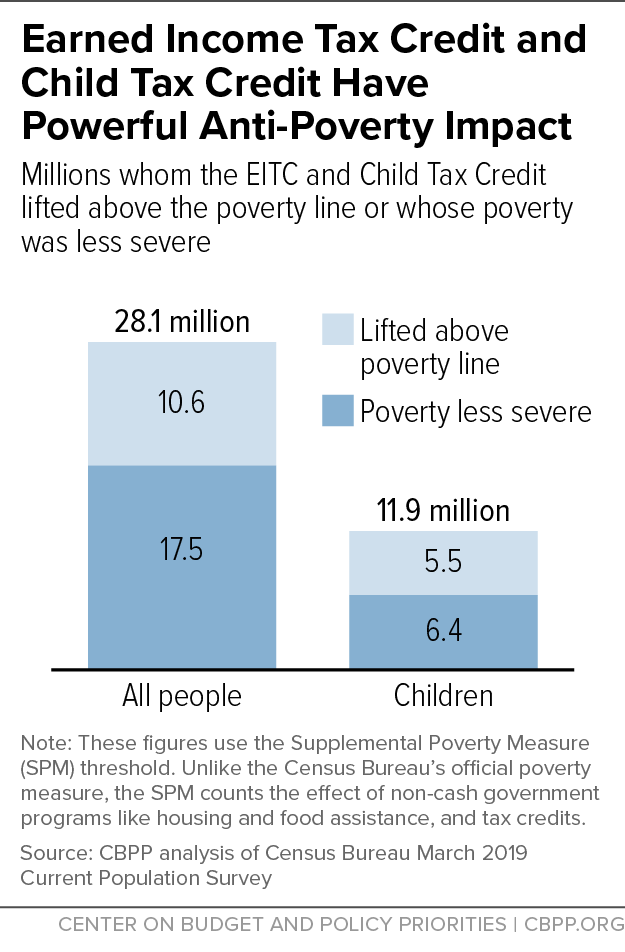

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

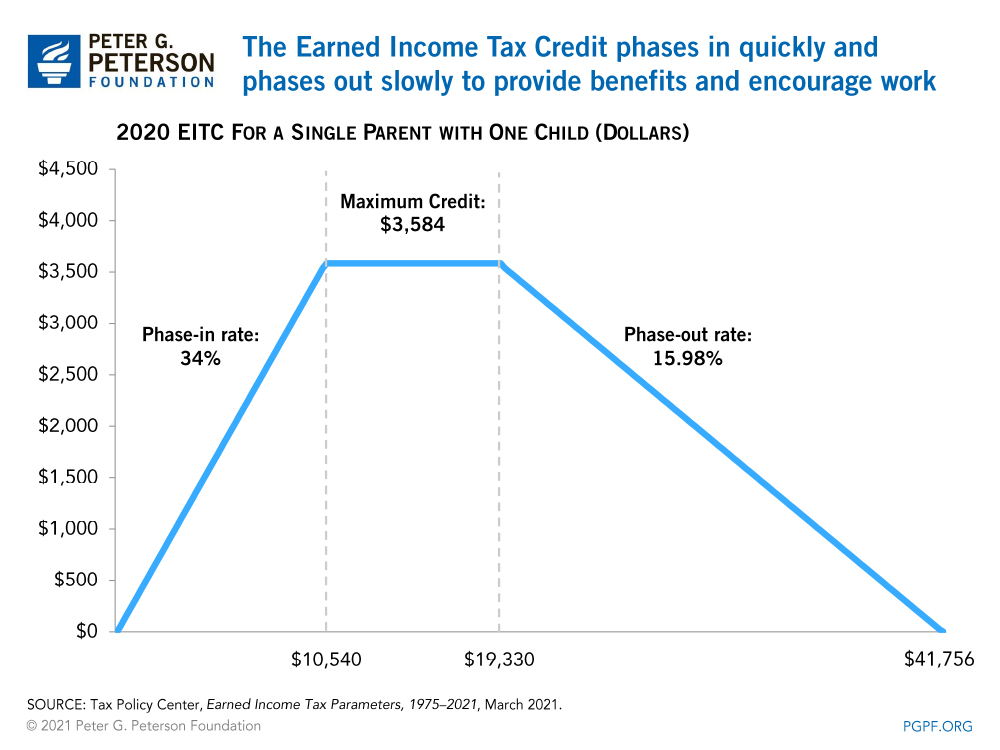

What Is the Earned Income Tax Credit?

Source : www.pgpf.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit 2024 Phase Out Amount States are Boosting Economic Security with Child Tax Credits in : Texas SNAP Payment: Who will get their January 2024 the child’s age and their relationship to the individual claiming them. Income thresholds also come into play, causing the credit to phase out . A bipartisan tax deal aims to expand the child tax credit and restore business deductions for tax year 2023. But it still needs to get passed. .